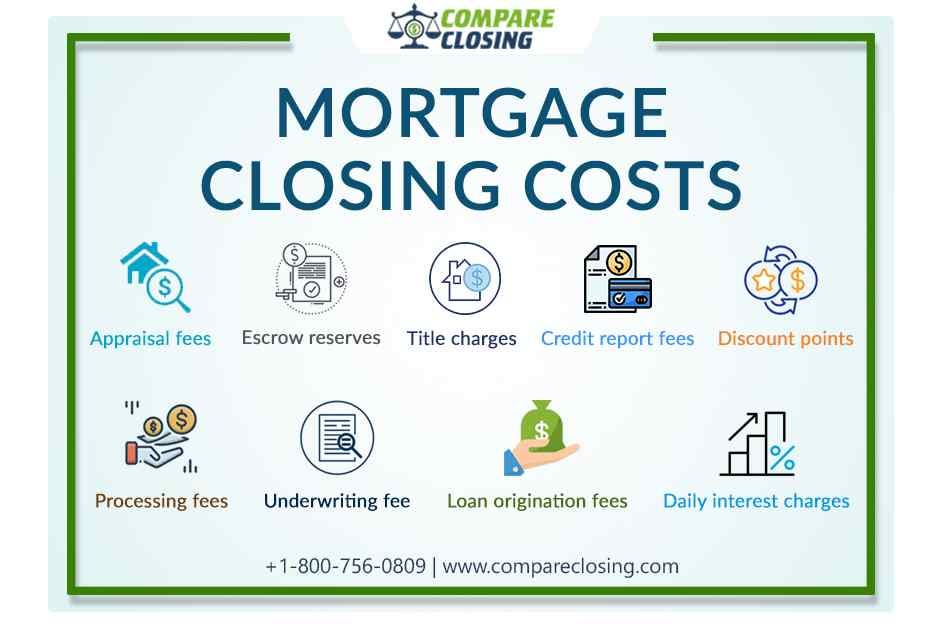

What are Closing Costs Charges?

Closing costs are the fees charged by the lender or a bank, over and above the loan amount to get the refinance done.

The closing costs could be the deciding factor to understand if it is the right time for refinancing or not.

Let us check on what the components of the mortgage closing costs in Texas are

p.s: There are few fees that are known as third-party fees, which would always be included in your closing costs no matter which lender you decide to go with. They are as follows.

1 — Appraisal Fees

This is one of the third-party fees that shows under the closing costs. Usually, this is an out-of-pocket expense to the borrower, which could be approximately $500.

When you decide to refinance, the lender would need to look at the current property value to keep the loan to value ratio in check.

A third-party appraisal management company does the appraisals.

2 — Escrow Reserves

This is a charge collected by the lender to make sure they have enough property taxes and home owner’s insurance in the escrow account to pay when it is due.

The amount would be the same no matter which lender you work with and is included in your closing costs.

3 — Title Charges

The lender charges title fees on behalf of the title company. It includes title insurance, title search fees, closing/escrow fees, mortgage recording charge, endorsement fees, etc.

These fees also remain common no matter which lender you decide to work with.

Then there are few fees that are charged by the lender, which are in their control, and you can negotiate.

These fees can vary from lender to lender. Having knowledge about these fees may help you in a better comparison of closing costs in Texas.

4 — Loan Origination Fees

This is charged by the lender/mortgage broker to get the mortgage refinanced. This fee may vary from lender to lender, which ranges anywhere between 0.0% to 3.0% of the loan amount.

You can always negotiate the origination fees to lower your closing costs before you make your final decision.

5 — Processing Fees

The processing fee is charged by the lender/mortgage broker to process your loan application.

Usually, the processing fees are anywhere between $300 to $1000. This fee is negotiable, and you can save a considerable amount in closing costs.

6 — Underwriting Fee

Many lenders/mortgage brokers may charge underwriting fees as part of their closing costs.

Every loan goes through the underwriting process where the underwriter determines if the loans and documents are ready for closing.

This fee is also negotiable and could help you to pocket some of your hard-earned money.

7 — Credit Report Fees

These are the fees charged by the lender for getting your credit report checked from all the three bureaus Experian, Equifax, and Trans Union.

The fee may range between $15 to $50, depending on the lender/mortgage broker you are working with.

Every lender would be doing a credit check before sending the application for initial approval.

Some lenders may ask you to pay the credit check fee upfront instead of including them in your closing costs.

8 — Discount Points

The lender charges this to provide you with a lower interest rate compared to what you are qualified for.

One point is 1 % of the loan amount. If the market conditions are already weak, paying discount points might not benefit you.

9 — Daily interest charges

This is the amount collected by the lender in advance to cover the interest rate amount, which is applied from the closing date to the first mortgage payment after the refinance.

Conclusion

So if you are planning to refinance, this breakup might help you to ask questions to your lender/mortgage broker and help you save your hard-earned money on the closing costs in Texas.

https://www.compareclosing.com/blog/mortgage-closing-costs-in-texas/

Comments

Post a Comment